Solutions for Well Informed Investors

The IRIS investment philosophy reflects a “Reinsurer’s approach” to capital markets—rooted in discipline, risk awareness, and selective deployment of capital. It combines:

- A prudent framework focused on capital preservation through real diversification and precise identification of worst-case scenarios.

- An opportunistic deployment strategy, where capital is invested only when risk/reward conditions are compelling—typically during imbalances in supply and demand. This means that portfolios are not always fully invested, and cash allocations may be significant when justified by market conditions.

More specifically, the IRIS strategy blends:

- A dislocation-driven approach targeting alpha from second-order risks and implied parameters—such as volatility, correlation, or dividend expectations—primarily in structured equity markets. These risks typically exhibit mean-reversion behaviour and can offer attractive carry, provided the entry point is well-calibrated. This is often referred to as Alternative Risk Transfer (ART).

- Targeted exposure to insurance-linked securities (ILS)—selecting strategies that capture high-margin, low-correlation returns from the (re)insurance risk market.

- Quantitative Investment Strategies (QIS): over our 20+ years of experience, we were able to watch and analyse market behaviours through a succession of bullish periods and crisis. We have developed an expertise in designing systematic strategies, based on highly liquid listed investments, that aim at capturing systematic risk premia and / or constructing diversified multi-asset absolute return portfolios.

- A suite of risk-controlled strategies, including Protected Assets and capital-preserving Structured Products, designed to maintain low exposure to market beta while offering income and downside resilience.

- A tactical cash reserve, maintained to take advantage of dislocations or second-order risk opportunities when the timing is optimal.

Through our long-standing relationships with leading investment banks and issuers, IRIS secures direct, competitive access without intermediaries. Our derivatives and investment banking expertise enables us to model, price, implement, and risk-manage a broad range of strategies — while understanding the flows behind market dislocations to source and time opportunities with precision.

The IRIS strategy seeks to deliver robust mid to high single-digit returns with low correlation to traditional equity and bond markets.

ART - Second Order Risks & Implied Parameters

Certain implied parameters, particularly those linked to structured product issuance, can become dislocated under specific market conditions. These parameters often display strong mean-reversion characteristics and, when timed correctly, can deliver significant positive carry. Our approach seeks to capture alpha by effectively acting as a reinsurer, absorbing risks that banks are unable or unwilling to retain.

- Dispersion strategies

- There is continual selling pressure on implied stock volatility driven by “auto-callable” structured products, reverse convertibles, and other issuance destined for retail and private bank clients.

- The flow dynamics are different for the index where asset managers, pensions and insurers hedge their equity exposure through index puts, driving up implied index volatility levels.

- The implied volatility of individual stocks tends therefore to be structurally cheap (relative to index volatility), while index volatility tends to be structurally expensive (likewise, relatively speaking). By buying the former and selling the latter, investor can expect to capture a premium. Below is an illustration of the positive carry of a dispersion trade structured by IRIS.

- Variance Swap on volatility-controlled index

- A partner bank was keen on recycling some of the risks accumulated via their insurance business (Fixed-Annuity products). This line of business makes banks short volatility on bespoke volatility-controlled indices.

- The trade illustrated below allows the sell side to offload part of this risk.

- The underlying is a volatility-controlled index on a subset of the S&P 500 index, published by S&P, with a volatility control mechanism targeting 5%. The stocks which make up the underlying index are “large caps” which have historically served high dividends.

- The trade will make a profit unless these stocks are hit by a string of unpredicted events, which would strengthen their volatility in a sudden manner.

- Dividend Futures

- Investment Banks heavily involved in selling structured products are often aggressively axed to recycle the dividends sensitivity coming from their auto-calls book.

- This can be achieved through “Athena Dividend” structures that offer attractive carry (e.g. double-digit coupons) and a discount on the level of the dividend futures.

- Should the product not be early redeemed, the steep dividend term structure on those stocks means Investor can benefit from a positive roll up. Below is an example of an Athena Div structure using BNP FP Equity as underlying that early redeemed after one year.

Targeted Exposure to insurance-linked securities

Insurance Linked Securities (ILS) such as Cat Bonds

have delivered superior and more stable returns compared to both equities and traditional bonds over nearly two decades, as demonstrates by the graph below. This strong historical performance suggests that ILS can be a

reliable source of long-term capital growth.

Investing in reinsurance as an asset class offers:

- Strong diversification benefits due to low correlation with financial markets. Reinsurance risks are not directly tied to macroeconomic cycles or equity market performance. Returns are primarily driven by insurance events of significance importance worldwide (e.g. hurricanes, earthquakes…) rather than interest rates or GDP growth. This makes them an excellent diversifier for traditional portfolios consisting of equities and bonds.

- During market downturns, such as the 2008 financial crisis or 2020 COVID crash, Reinsurance risks showed resilience, with minimal drawdowns compared to equities.

- Adding reinsurance exposure can reduce portfolio volatility and improve the risk-return profile.

- Attractive, risk-adjusted returns with lower volatility. Reinsurance risks tend to offer high yields relative to their risk profile. Investors are compensated for taking on catastrophe event risk, which is uncorrelated with financial markets. Historically, Reinsurance risks have provided equity-like returns with bond-like volatility.

- A way to hedge against inflation and systemic financial risks. Unlike traditional bonds, the performance of Cat bonds is not directly eroded by inflation.

- Insurance premiums and payouts are recalibrated annually, keeping pace with inflationary pressures.

- This feature allows Reinsurance risks to maintain real returns, offering a hedge against inflation risk.

For institutional investors or diversified portfolios, allocating a portion to reinsurance-linked securities can enhance overall portfolio resilience and return potential.

Innova Re Investment Solutions Ltd specialized in sourcing attractive reinsurance risks investment opportunities as illustrated by the below graph.

GRAPH 1 – Gross Performance of IRIS selected reinsurance risks investment. Period 01/2019 – 04/2023.

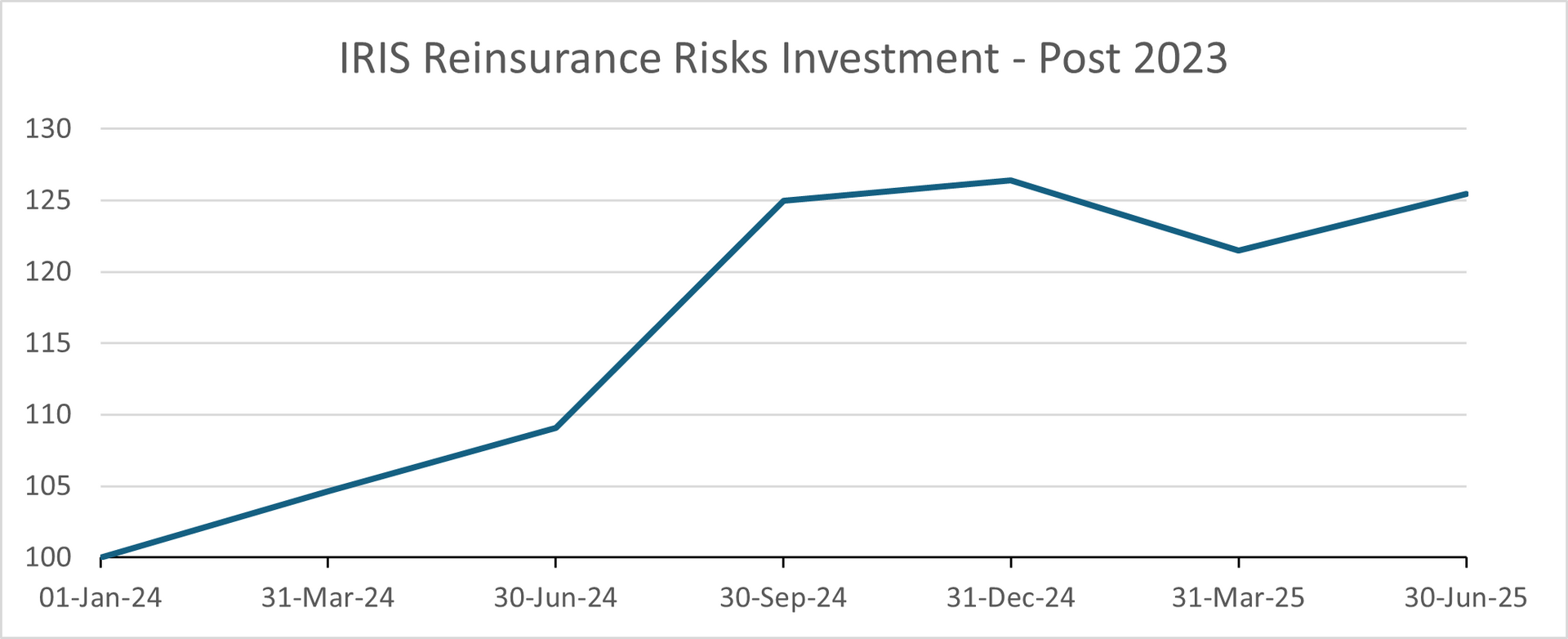

In 2023 IRIS changed its allocation to reinsurance risks to better benefit from the most attractive environment for property catastrophe reinsurance underwriting post-2005 (KRW). Indeed inflation, CAT activity and reinsurer / investor capital allocation decisions drove a significant repricing in 2023, exacerbated by Hurricane Ian.

GRAPH 2 – Gross Performance of IRIS selected reinsurance risks investment. Period 01/2024 – 06/2025

Quantitative Investment Strategies

Premium Harvesting strategy (similar approach to Reinsurance but through highly liquid and very short-term instruments)

This includes systematic selling short term Put options on stock indices (SPX Index, NDX Index, SX5E Index…)

Income strategies through attractive capital protected investments

- Targeted Accrued Redemption Note (TARN)

- The high inflation which has prevailed in 2022 and 2023 has pushed the Central Banks to adopt a restrictive policy since March 2022, in an attempt to control the inflationary pressures in the economy. In this context, the EUR yield curve has become inverted, with the spread between long and short tenors turning negative.

- Our expectation is that the high rates will eventually stifle inflation, leading to a normalization of the shape of the yield curve.

- IRIS structured a capital guaranteed product (TARN) that takes advantage of this scenario.

- The payoff benefits in a scenario where the EUR interest rate curve normalizes (switch from downward to upward slope) in the medium term (3-5 years horizon). The expected return of the product is 10% p.a. with a 3Yr duration.